Another Revamp of Form 1040? IRS Proposes Changes for 2019 – Including a New Tax Form for Seniors

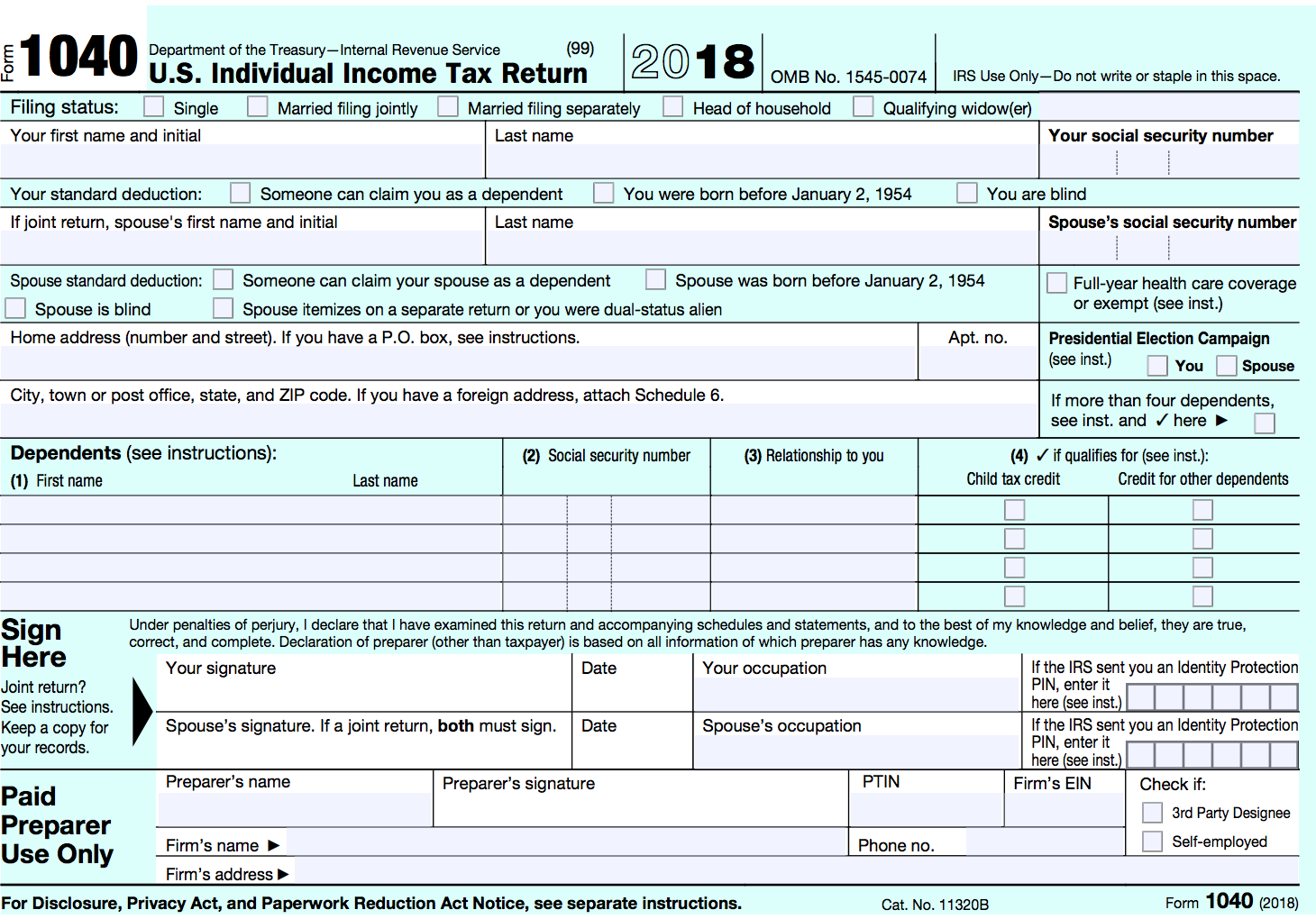

The Internal Revenue Service has released a draft version of 2019 Form 1040, along with a new tax form for seniors aged 65 and over, Form 1040-SR. While both forms arguably represent an improvement over the “postcard size” 2018 Form 1040 in terms of being easier to read and to follow, the idea of creating a special tax form for older filers raises certain practical and ethical problems, which will be discussed in this article along with the more significant changes that the IRS proposes to make to Form 1040.

The full article can be found here: Another Revamp of Form 1040

(Published: July 29, 2019)

The Tax Cuts and Jobs Act of 2017 and Your Federal Income Tax Return

The Tax Cuts and Jobs Act of 2017 (TCJA), enacted into law in December 2017, represents the most significant and comprehensive change to the federal tax code in over 30 years. Among its other provisions, the TCJA lowered income tax rates and effectively doubled the standard exemption for most individual taxpayers, while also reducing the corporate income tax rate from 35% to 21%. Additionally, the TCJA eliminated the personal and dependent exemptions, and also repealed or capped a number of widely-used deductions, including those for unreimbursed employee expenses (repealed), work-related moving expenses (repealed for all but active members of the military), and state and local taxes (capped at $10,000). These changes have been accompanied by a significant redesign of Form 1040, the main form used for filing federal income taxes.

While this article, originally published in December 2018, is not intended to provide a comprehensive listing of all of the changes made to the federal tax law by the TCJA, or to substitute for the guidance of a professional tax planner, it will hopefully answer many of your questions regarding how the TCJA may have affected your federal return.

The full article can be found here: The Tax Cuts and Jobs Act of 2017 and Your Federal Income Tax Return

(Published: December 19, 2018)